where's my unemployment tax refund irs

Viewing the details of your IRS account. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

Where S My Refund Taxpayers Still Waiting For 2020 Irs Return Abc11 Raleigh Durham

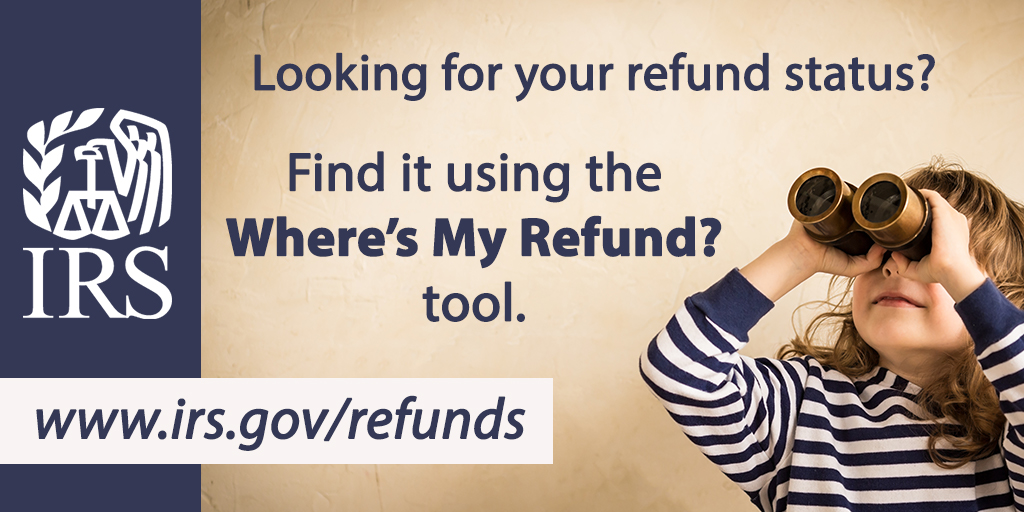

Using the IRSs Wheres My Refund feature.

. IR-2021-159 July 28 2021. A direct deposit amount will likely. Check For the Latest Updates and Resources Throughout The Tax Season.

Where is my unemployment tax break refund. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check.

24 4 see if. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Ad Learn How Long It Could Take Your 2021 Tax Refund.

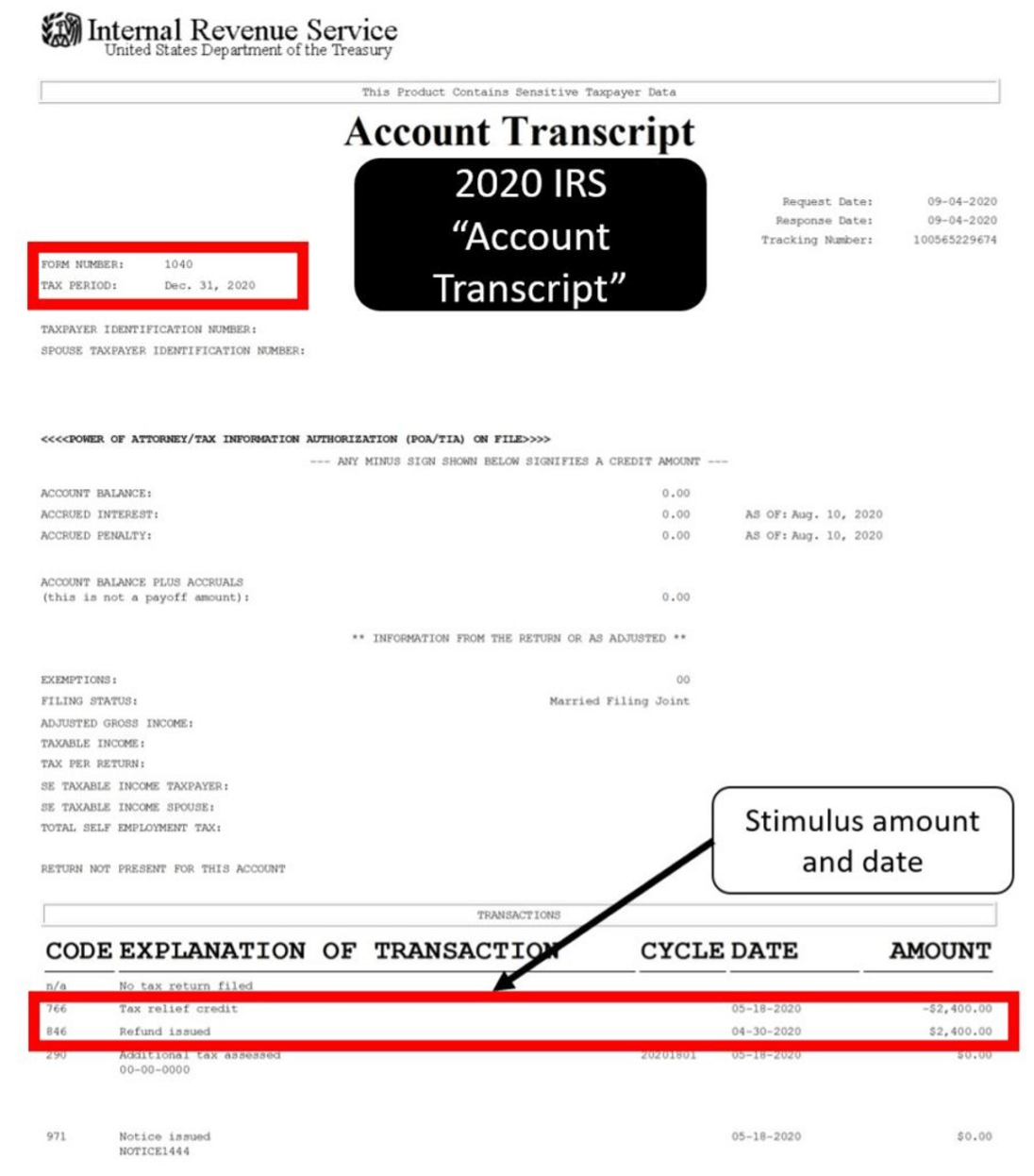

23 3 check your bank account. 22 2 verify your identify. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return. 2 Things you can do if you havent received your refund. In late May the IRS started.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. 21 1 check that your return was received by the IRS. See How Long It Could Take Your 2021 Tax Refund.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. With the fourth batch of payments now going out the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion. The unemployment tax refund is only for those filing individually.

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Unemployment 10 200 Tax Break Some States Require Amended Returns

Irs Unemployment Refunds Moneyunder30

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Transcripts Now Provide Stimulus Payment Information Jackson Hewitt

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Unemployed In 2020 Get Ready For A Big Tax Refund

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

430 000 People To Receive Surprise Tax Refund From Irs

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Where Is My 2 200 Irs Slow To Rollout Unemployment Tax Refund The National Interest

Confused About Unemployment Tax Refund Question In Comments R Irs

Tax Refund Delay What To Do And Who To Contact Smartasset

1099 G Unemployment Compensation 1099g

Irsnews On Twitter Use The Where S My Refund Tool To Start Checking The Status Of Your Refund 24 Hrs After Irs Acknowledges Receipt Of Your E Filed Tax Return You Can Access The